The private aviation sector has witnessed significant growth worldwide over the past decade, driven by increasing demand for convenience, time-efficiency, and exclusivity. Within this global context, private jets in India have emerged as an important segment, reflecting the country’s expanding economy and rising affluent population. Although still developing compared to mature markets like the United States and Europe, India’s private jet market is evolving rapidly with increasing ownership, charter services, and infrastructural developments.

This article aims to provide a comprehensive overview of private jets in India, focusing on market dynamics, regulatory frameworks, recent policy updates, and industry trends. By examining these facets, the article intends to help readers understand the complexities of the private jet ecosystem in India and how regulatory and infrastructural factors shape its growth. The content draws from credible sources such as the Directorate General of Civil Aviation (DGCA), Ministry of Civil Aviation, and industry reports to ensure factual accuracy and clarity.

Private Jets in India: Market Overview and Key Facts

Types of Private Jets in India

The private jets market in India encompasses a diverse range of aircraft categorized by size, seating capacity, range, and operational usage. These categories broadly include light jets, midsize jets, and heavy jets, each serving distinct travel requirements:

- Light Jets:

Designed primarily for short-range domestic travel and small groups (typically 4-7 passengers), light jets are favored for their cost efficiency and quick turnaround. Popular models include:- Cessna Citation Mustang: Entry-level, 4-5 passengers, range approx. 1,150 nautical miles.

- Embraer Phenom 100: Compact, efficient, with a range around 1,200 nautical miles.

- HondaJet: Innovative design, 4-5 passengers, range approx. 1,223 nautical miles.

- Midsize Jets:

Serving medium-haul routes with 6-9 passengers, midsize jets offer more cabin space and comfort, suitable for both business and leisure. Key models used in India include:- Bombardier Challenger 350: A favorite in India, with a range near 3,200 nautical miles and room for up to 10 passengers.

- Hawker 900XP: Known for reliability, with a 2,800-nautical mile range.

- Citation XLS+: Popular midsize jet with a range of about 2,100 nautical miles. For a broader list of top private jets worldwide, check out Best Private Jets

- Heavy Jets:

Designed for long-distance, intercontinental travel, heavy jets can accommodate 10-18 passengers in luxurious cabins. These jets are preferred by ultra-high-net-worth individuals and large corporations:- Gulfstream G450/G550/G650: Gulfstream’s series of ultra-long-range jets, with ranges from 4,350 to 7,000 nautical miles. The G650 is among the fastest and longest-range private jets globally. Private jets often fly faster than commercial airliners, offering significant time savings. Read more on Are private jets faster than commercial jets?

- Bombardier Global Express: Capable of 6,000+ nautical miles, ideal for nonstop international travel.

- Dassault Falcon 7X: Known for efficiency and advanced technology, with a range over 5,900 nautical miles.

These jets are also capable of long-haul flights, with some models flying nonstop for 12 hours or more. Learn more about can a private jet fly for 12 hours.

Market Size and Fleet Composition

India’s private jet fleet is relatively nascent but growing steadily:

- Estimates indicate there are approximately 150 to 200 private jets registered in India as of 2024. This number reflects an annual growth rate of roughly 10-12%, driven by rising demand from corporate entities and ultra-wealthy individuals.

- The market is fragmented between owner-operated jets, charter services, and fractional ownership programs. The rise of on-demand charter platforms has made private jet access more flexible and cost-efficient.

- Leading private jet operators in India include:

- Taj Air: One of the oldest private jet operators in India, part of the Taj Group, offering ownership and charter services.

- JetSetGo Aviation: India’s largest charter operator, noted for its extensive fleet and technology-driven booking platform.

- Club One Air: Provides charter and fractional ownership with a strong presence in luxury and corporate travel.

- The fleet composition is dominated by midsize and heavy jets, reflecting India’s mix of domestic and international travel needs.

Geographic Distribution and Regional Trends

- The bulk of private jet traffic is concentrated around India’s primary economic centers:

- Mumbai: India’s financial capital with high corporate jet activity.

- Delhi-NCR: The political and administrative hub with growing demand for private aviation.

- Bengaluru: The IT and startup hub driving tech-industry business travel.

- Hyderabad: An emerging corporate center with increasing private aviation services.

- Regional expansion is gaining momentum due to government initiatives like UDAN (Ude Desh ka Aam Naagrik), aimed at improving air connectivity across smaller cities. This is opening opportunities for private jets to service secondary airports and tier-2/3 cities, a trend expected to accelerate with improved airport infrastructure and rising regional affluence.

Cost Factors Influencing the Private Jet Market in India

Cost remains a critical determinant in the growth and accessibility of private jets in India:

- Acquisition Costs:

- Light jets typically range between USD 3 million and USD 8 million.

- Midsize jets are priced from USD 8 million to USD 20 million.

- Heavy jets can exceed USD 30 million, with ultra-long-range jets like Gulfstream G650 costing upwards of USD 70 million.

- Operational Costs:

- The average hourly operating cost for midsize jets ranges between USD 2,500 and USD 4,000, factoring in fuel, maintenance, crew salaries, hangar fees, and insurance.

- Fuel efficiency and variable pricing of aviation fuel in India significantly influence operational expenditure.

- Compliance with DGCA regulations adds costs related to safety audits, crew training, and documentation.

- Additional Costs:

- Import duties on aircraft and parts in India can add a significant premium, often exceeding 20-30%.

- Taxes such as GST (Goods and Services Tax) apply to charter services, impacting pricing models.

- Ground handling fees, airport charges, and customs procedures contribute to overall expenses.

Impact of the COVID-19 Pandemic on Private Jets in India

The COVID-19 pandemic created a unique dynamic for private jets in India:

- While commercial aviation suffered drastic downturns due to travel restrictions and passenger concerns, private jet demand surged significantly.

- Corporates and wealthy individuals prioritized private travel for enhanced safety, privacy, and flexibility, causing a spike in charter bookings and aircraft acquisitions.

- This shift exposed the strategic value of private aviation in crisis situations and encouraged further investments in the sector.

International Comparison: Positioning India in the Global Private Jet Landscape

- Globally, the United States leads with over 20,000 private jets, followed by Europe and parts of the Middle East.

- India’s fleet size remains modest but is growing faster than many emerging markets.

- Factors such as increasing high-net-worth individuals, infrastructural development, and regulatory reforms are driving India’s catch-up.

- Compared to China, which has around 700 private jets, India’s market is smaller but shows comparable growth trajectories.

Regulatory Framework Governing Private Jets in India

Role of the Directorate General of Civil Aviation (DGCA)

The Directorate General of Civil Aviation (DGCA) is the primary regulatory authority overseeing civil aviation activities in India, including the operation and safety of private jets in India. The DGCA formulates policies, issues licenses, and ensures compliance with national and international aviation standards.

Licensing and Certification Requirements

- Air Operator’s Permit (AOP): Any entity operating private jets commercially must obtain an AOP from DGCA.

- Non-Commercial Operations: Private jet owners can operate aircraft under non-commercial use with appropriate permits.

- Aircraft Registration: All private jets must be registered with DGCA and comply with Indian Aircraft Rules, 1937.

- Pilot Licensing: Pilots must hold valid licenses issued by DGCA and meet specific flight hour requirements for private jet operations.

Airworthiness and Safety Standards

- Regular airworthiness inspections and maintenance audits are mandatory.

- Compliance with DGCA’s CAR (Civil Aviation Requirements) Part IV (Airworthiness) ensures safety and operational integrity.

- DGCA mandates adherence to international standards such as ICAO Annex 6 (Operation of Aircraft) for private jets. To understand which models are considered the safest worldwide, see What is the safest private jet in the world?

Import and Taxation Policies

- Import of private jets is subject to customs duty and GST, with cumulative taxes significantly impacting acquisition costs.

- DGCA coordinates with customs and taxation authorities to regulate imports and taxation compliance for private jets.

Charter and Operational Regulations

- Private jets offering charter services must comply with commercial operation norms under DGCA guidelines.

- Operators must maintain records, conduct regular safety audits, and ensure crew training meets prescribed standards.

- Restrictions apply on routes, flight timings, and landing rights, governed by bilateral air service agreements.

Recent Regulatory Updates

- DGCA has introduced streamlined approval processes for private jet operators to encourage sector growth.

- Emphasis on environmental compliance through noise certification and emission standards aligned with global norms.

- Implementation of stricter safety audits following international best practices.

- Introduction of digital platforms to simplify licensing and operational permissions.

Challenges in Regulatory Compliance

- Complex bureaucratic procedures can delay approvals for private jet operations.

- High taxes and import duties remain a concern for private jet owners and operators.

- Infrastructure limitations at smaller airports challenge expansion despite regulatory support.

Recent Industry Developments and Policy Changes

DGCA Announcements and Policy Updates

- DGCA has introduced faster approval processes to encourage growth in the private jets in India sector.

- New safety audit protocols aligned with global aviation standards were implemented in 2023.

- Enhanced environmental regulations require compliance with noise and emission standards for private jets.

Government Initiatives Promoting Private Aviation

- The UDAN scheme aims to improve regional connectivity, indirectly boosting private jet access to tier-2 and tier-3 cities.

- Infrastructure development plans include expansion of Fixed Base Operators (FBOs) and dedicated private jet terminals at major airports.

- Public-Private Partnerships (PPP) are encouraged for airport modernization supporting private aviation.

Market Expansion and Foreign Investment

- Increased foreign direct investment (FDI) in private aviation services has been observed since the relaxation of ownership norms.

- International operators and manufacturers are partnering with Indian firms to tap into the growing market.

- Introduction of tech-driven platforms for private jet chartering, such as app-based booking systems, has improved market accessibility.

Notable Private Jet Acquisitions and Market Entries

- Several high-net-worth individuals and corporations have added new jets to their fleets amid rising demand. Some owners even possess multiple aircraft; learn who owns 10 private jets or more here.

- Global private jet manufacturers like Gulfstream and Bombardier have expanded their presence with localized sales and maintenance services.

- Indian charter companies such as JetSetGo have raised significant funding rounds to scale operations.

Infrastructure and Support Services for Private Jets in India

Growth of Fixed Base Operators (FBOs)

- FBOs provide essential ground services such as fueling, hangaring, maintenance, and passenger handling for private jets.

- Major Indian airports including Mumbai, Delhi, Bengaluru, and Hyderabad have established FBOs catering to private aviation needs.

- New FBOs are being planned at emerging airports to support growing regional private jet traffic.

Private Jet Hangars and Maintenance Facilities

- Dedicated hangars ensure secure storage and protection from weather elements. Wondering where private jets are typically kept when not in use? Find out where do people keep their private jets

- Maintenance, Repair, and Overhaul (MRO) facilities are critical for aircraft safety and airworthiness compliance.

- Several Indian airports now host authorized MRO centers specializing in private jets, improving turnaround times.

Airport Slot Allocation and Airspace Management

- Private jets often face challenges in obtaining airport slots due to prioritization of commercial airlines.

- Efficient airspace management is essential to accommodate the growing number of private flights without disrupting commercial traffic.

- DGCA and Airport Authorities are working on improved slot allocation protocols and airspace reforms.

Ground Handling, Customs, and Immigration

- Ground handling services for private jets include baggage handling, catering, and passenger services tailored for exclusivity and privacy.

- Customs and immigration processes at international airports have dedicated channels for private jet passengers, enabling faster clearance.

- Increasing integration of digital systems is enhancing service efficiency.

Key Airports Facilitating Private Jet Operations

- Mumbai (Chhatrapati Shivaji Maharaj International Airport): India’s busiest FBO hub.

- Delhi (Indira Gandhi International Airport): Major international gateway with extensive private aviation facilities.

- Bengaluru (Kempegowda International Airport): Strong presence of corporate aviation and FBO services.

- Hyderabad (Rajiv Gandhi International Airport): Growing private jet infrastructure with new FBOs under development.

Environmental and Safety Considerations

Environmental Impact of Private Jets

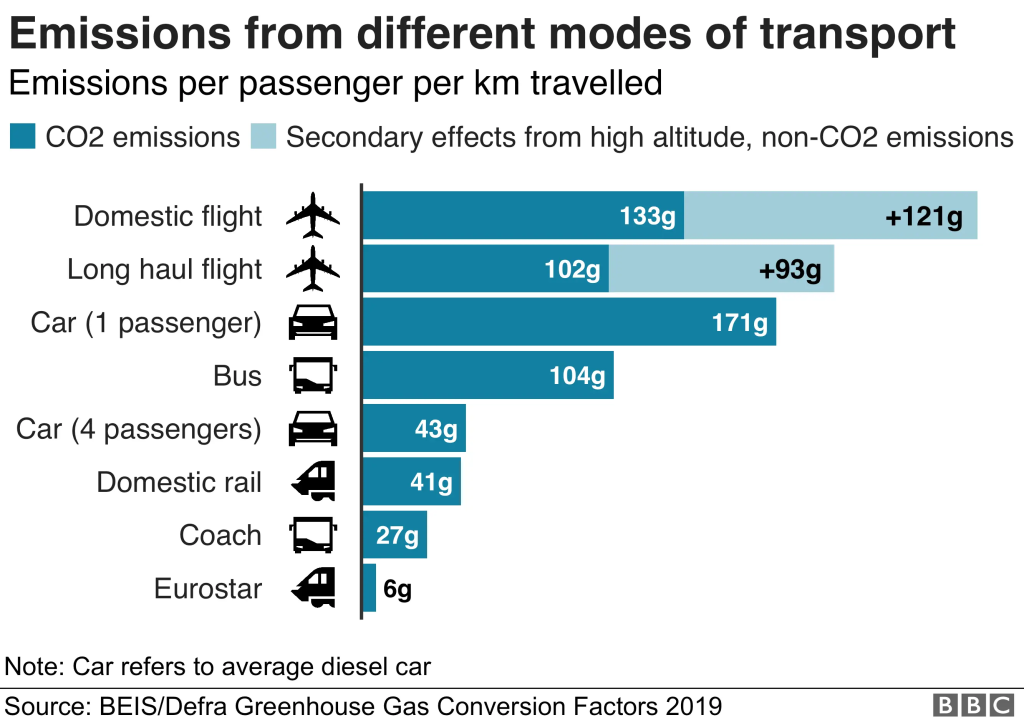

- Private jets contribute to aviation emissions, including CO₂ and nitrogen oxides, which impact air quality and climate change.

- Although private jets represent a small percentage of total aviation emissions in India, their per-passenger carbon footprint is significantly higher than commercial flights.

- Noise pollution is a concern, especially near urban airports where private jet operations are concentrated.

Regulatory Measures on Environment

- DGCA enforces noise certification standards based on ICAO Chapter 3 and Chapter 14 noise norms for private jets.

- Emission standards are aligned with global ICAO guidelines to minimize environmental impact.

- Ongoing discussions encourage adoption of Sustainable Aviation Fuel (SAF) and newer technologies to reduce carbon footprints.

Safety Audits and Compliance

- DGCA mandates regular safety audits and maintenance checks under Civil Aviation Requirements (CAR) for all private jets.

- Operators must adhere to strict crew training and certification standards to maintain high safety levels.

- Incident and accident reporting protocols ensure transparency and continuous improvement in safety practices.

Advances in Sustainable Technologies

- Global trends include development of electric and hybrid-electric private jets, potentially reducing emissions and noise.

- India’s private aviation sector is monitoring these technologies but wide adoption is still in early stages.

- Initiatives promoting SAF use in India are nascent but expected to grow with government and industry collaboration.

Community Concerns and Noise Mitigation

- Airports have implemented noise abatement procedures, including flight path modifications and operational restrictions during night hours.

- Dialogue with local communities is encouraged to address concerns related to private jet operations.

Challenges and Regulatory Considerations Impacting the Growth of Private Jets in India

Regulatory Hurdles

- Lengthy and complex approval processes by the Directorate General of Civil Aviation (DGCA) often delay private jet operations and acquisitions.

- Obtaining Air Operator’s Permits (AOP) and other certifications requires extensive documentation and compliance checks.

- Frequent updates and changes in regulations can create uncertainty for operators and owners.

Infrastructure Limitations

- Shortage of dedicated private jet terminals and Fixed Base Operators (FBOs) at smaller airports restricts growth beyond major metro cities.

- Limited hangar space and maintenance facilities impact operational efficiency and increase turnaround times.

- Airport slot constraints due to priority given to commercial airlines can cause scheduling challenges.

Financial and Taxation Challenges

- High import duties and taxes on private jets and aviation fuel significantly raise acquisition and operational costs.

- Goods and Services Tax (GST) and customs duties add to the financial burden on operators and owners.

- Lack of financial incentives or subsidies compared to commercial aviation sectors.

Airspace Management and Congestion

- Increasing air traffic congestion in Indian skies complicates route planning and air traffic control for private jets.

- Commercial flights are often prioritized, causing delays and longer waiting times for private jet clearances.

- Need for modernization and integration of airspace management systems to accommodate growing private aviation traffic.

Safety and Security Concerns

- Maintaining compliance with international safety standards requires continuous crew training and aircraft maintenance investments.

- Privacy and security protocols are critical for high-profile private jet users, necessitating additional operational measures.

- Cybersecurity risks related to digital platforms and avionics systems. For insights on the safety of older private jets, see Is a 20-year-old private jet safe?.

Environmental and Community Issues

- Pressure to comply with stricter emission norms and noise pollution controls may increase costs.

- Community resistance due to noise pollution and perceived exclusivity of private jets in residential areas.

- Balancing environmental sustainability with business growth remains a key policy challenge.

Industry and Policy Advocacy

- Industry bodies like the Business Aircraft Operators Association (BAOA) work with regulators to streamline policies.

- Calls for regulatory reforms to simplify approvals, reduce taxation, and improve infrastructure.

- Comparison with global best practices highlights areas for policy improvement in India.

Future Outlook for Private Jets in India

Emerging Market Trends

- Growth in digital booking platforms and mobile apps is increasing accessibility to private jet charters.

- Fractional ownership and jet card programs are gaining popularity, making private jet travel more affordable and flexible.

- Increasing interest in air taxi services and urban air mobility solutions may reshape short-haul private travel.

Infrastructure and Policy Developments

- Planned expansion of Fixed Base Operators (FBOs) and dedicated private jet terminals at major airports is expected to enhance service quality.

- Continued government support for regional connectivity under schemes like UDAN will open new markets for private jets in tier-2 and tier-3 cities.

- Policy reforms aimed at reducing taxation and simplifying approvals are anticipated to accelerate sector growth.

Technological Innovations

- Adoption of Sustainable Aviation Fuel (SAF) and exploration of electric and hybrid-electric aircraft could reduce environmental impact.

- Integration of advanced avionics and digital navigation systems will improve safety and efficiency.

- Increased use of data analytics and AI for predictive maintenance and flight operations optimization.

Market Growth Projections

- The Indian private jet market is projected to grow at a compound annual growth rate (CAGR) of 10-12% over the next decade.

- Rising high-net-worth individuals (HNWIs) and expanding corporate sectors will drive demand.

- Growing international connectivity and business travel needs will increase long-haul private jet usage.

Challenges and Considerations

- Infrastructure development must keep pace with fleet growth to avoid operational bottlenecks.

- Balancing environmental sustainability with market expansion remains critical.

- Regulatory clarity and supportive policies will be essential for sustained growth.

Conclusion

The landscape of private jets in India is evolving rapidly, shaped by growing demand, regulatory developments, and infrastructural enhancements. While India’s private jet market remains relatively nascent compared to global leaders, it shows significant potential driven by increasing wealth, expanding corporate sectors, and government initiatives such as the UDAN scheme.

Regulatory frameworks administered by the Directorate General of Civil Aviation (DGCA) play a crucial role in balancing safety, environmental considerations, and market growth. Recent policy updates reflect an effort to streamline approvals, enhance environmental compliance, and foster infrastructure development.

Despite challenges related to taxation, airspace management, and infrastructure gaps, the private jet sector in India is positioned for robust growth. Emerging trends in digital platforms, fractional ownership, and sustainable aviation technologies promise to transform accessibility and environmental impact in the coming years.

A coordinated approach involving policymakers, industry stakeholders, and infrastructure providers will be essential to ensure that the growth of private jets in India aligns with safety, environmental sustainability, and economic objectives. This balanced progression will support the sector’s contribution to India’s broader civil aviation ecosystem and economic development.

What are your thoughts on the future of private jets in India? Have you noticed any recent changes in regulations or industry trends? Share your insights, experiences, or questions in the comments below—we’d love to hear your perspective and start a meaningful conversation!