The global private aviation sector has witnessed significant growth over the past decade, driven by increasing demand from high-net-worth individuals (HNWIs) and corporations seeking time-efficient, secure, and flexible travel solutions. India, as one of the fastest-growing major economies, has experienced a parallel surge in private jet ownership. Understanding how many Indians have private jets is critical to grasping the evolving landscape of luxury travel and corporate aviation in the region.

In India, the growing number of affluent individuals and expanding business conglomerates are fueling demand for private aviation, highlighting a shift from traditional commercial travel to personalized, on-demand air transport. This transformation is shaped by factors such as increasing globalization, infrastructural improvements, and changing lifestyle preferences.

This article delves into the current statistics of private jet ownership among Indians, analyzing market trends, cost-benefit considerations, and technological innovations shaping this sector. By providing precise data and strategic insights, readers will be equipped to make well-informed decisions regarding luxury travel options and private jet technology investments in India.

How Many Indians Have Private Jets — Current Statistics and Ownership Trends

Overview of Private Jet Ownership in India

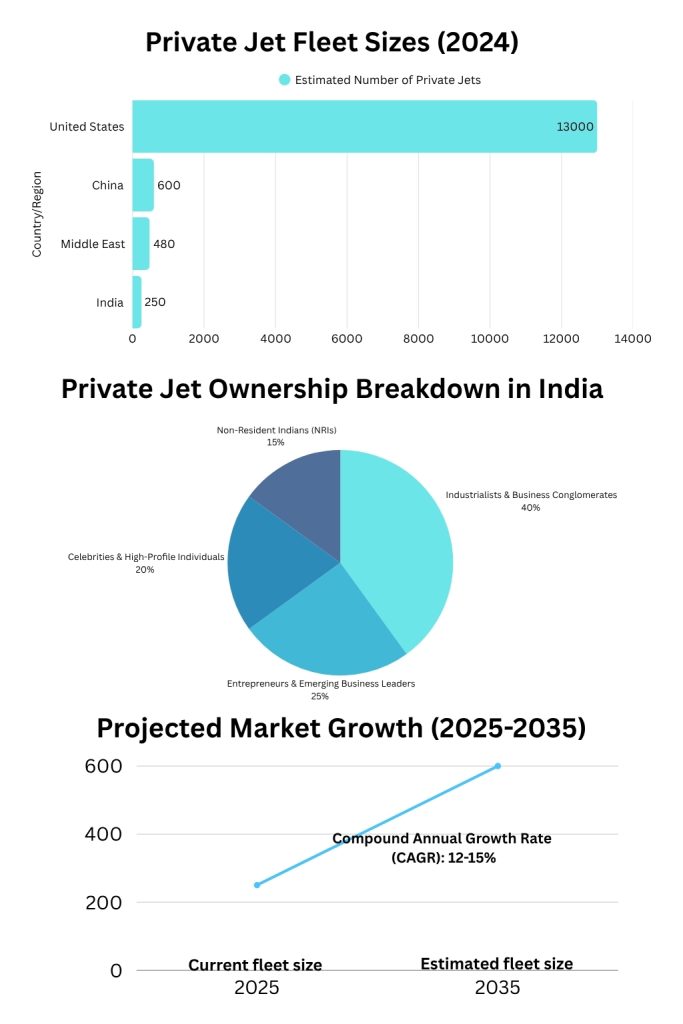

The question how many Indians have private jets is crucial to understanding the private aviation sector’s evolution in India. As of 2024, India has an estimated 200 to 250 privately owned jets, a number that has grown steadily over recent years. Although this fleet size is small compared to the United States (over 13,000 jets) and China (around 600 jets), India is among the fastest-growing private jet markets globally.

This rise reflects the expanding base of high-net-worth individuals (HNWI), increasing corporate travel demands, and a shift in travel preferences toward convenience and privacy.

Growth Trends and Ownership Breakdown

The Directorate General of Civil Aviation (DGCA) reports a 30% growth in private jet registrations over the past five years in India. The primary owners include:

- Industrialists and Corporate Conglomerates: Business families like the Ambanis, Adanis, and Birlas lead private jet ownership, using jets to manage dispersed business interests efficiently. In some high-profile cases, individuals have been known to own as many as 10 private jets, underscoring the scale of usage.

- Entrepreneurs and Business Leaders: Especially in IT, pharmaceuticals, and manufacturing, many entrepreneurs invest in private jets to facilitate rapid domestic and international connectivity.

- Celebrities and High-Profile Individuals: Bollywood stars and sports personalities increasingly opt for private jets for privacy and luxury. The rise of celebrity private jets highlights how personal branding and exclusivity drive demand in this segment.

- Non-Resident Indians (NRIs): Many NRIs own private jets to ease frequent travel between India and abroad.

This ownership diversity highlights how private jets serve both luxury and business purposes in India.

Types of Jets Favored by Indian Owners

Indian private jet owners prefer a variety of aircraft, reflecting their different travel needs:

- Light Jets: Popular models include the Cessna Citation series and Embraer Phenom 300, ideal for domestic and short-haul routes with costs ranging between USD 5-10 million.

- Midsize Jets: Aircraft such as the Bombardier Challenger 350 cater to longer domestic and regional flights.

- Large and Ultra-Long-Range Jets: Gulfstream G650, Dassault Falcon 8X, and Bombardier Global 7500 are preferred for international travel, with prices exceeding USD 50 million.

Buyers typically evaluate the best private jets based on range, interior customization, and brand reputation.

This mix demonstrates that Indian owners use private jets for everything from regional hops to global business trips. Many of these jets are capable of extended flight durations, prompting the question: can a private jet fly for 12 hours?

India Compared to Other Private Jet Markets

While India’s private jet ownership is growing rapidly, its absolute numbers lag behind:

- United States: Over 13,000 private jets, supported by a mature infrastructure.

- China: Approximately 600 private jets, with strong government backing.

- Middle East: Large fleets driven by oil wealth and global business hubs.

However, India’s private jet market is projected to expand at a 12-15% compound annual growth rate (CAGR) over the next decade, positioning it as a major emerging market.

Key Drivers of Growth in Indian Private Jet Ownership

Several factors fuel the increasing number of Indians who have private jets:

- Expanding HNWI Population: With over 830,000 HNWIs, India ranks among the top countries for wealth creation.

- Business Expansion: Growing multinational companies and startups require fast, flexible travel options.

- Infrastructural Gaps: Limited commercial connectivity between smaller cities makes private jets practical for intra-country travel.

- Preference for Privacy and Luxury: High-net-worth individuals increasingly favor private jets for their convenience, exclusivity, and security.

Emerging Ownership Models

Although full ownership dominates, alternative models like fractional ownership and jet cards are gaining traction. These models reduce costs and increase accessibility, allowing more individuals and companies to use private jets without the full financial burden of ownership. Other verticals like rotorcraft are also gaining traction—see this private helicopter price list for growing alternatives in luxury air travel.

Summary

- Private jets in India currently number around 200 to 250, owned by individuals and corporations.

- Ownership includes industrialists, entrepreneurs, celebrities, and NRIs.

- Popular aircraft range from light jets for domestic use to ultra-long-range jets for international travel.

- India’s private jet market is one of the fastest-growing globally, with an estimated CAGR of 12-15%.

- Growth is driven by increasing wealth, business needs, infrastructural challenges, and evolving luxury preferences.

- Fractional ownership and jet card programs are expanding market accessibility. Leasing options are also gaining traction, with multiple companies offering private jets for lease across India.

Overview of India’s Private Jet Market: Supply, Demand, and Key Players

Market Size and Fleet Composition

India’s private jet market, though relatively nascent compared to Western economies, has demonstrated significant growth driven by rising demand from high-net-worth individuals (HNWI) and corporate entities. As of 2024, the fleet comprises roughly 200 to 270 aircraft, dominated by light and midsize jets used predominantly for domestic and regional travel. Larger long-range jets, while fewer, are gaining popularity for international business connectivity.

The current fleet composition reflects market preferences:

- Light Jets (e.g., Cessna Citation, Embraer Phenom): Approximately 60% of the fleet, favored for short-haul routes and cost efficiency.

- Midsize Jets (e.g., Bombardier Challenger 350): Represent around 25%, balancing range and comfort.

- Large and Ultra-Long-Range Jets (e.g., Gulfstream G650, Dassault Falcon): About 15%, increasingly used for global business travel.

Demand Drivers

Several factors underpin demand for private jets in India:

- Growing Business Aviation Needs: With India’s expanding economy and corporate sector, executives require flexible, time-efficient travel solutions to manage operations across multiple locations.

- Limited Commercial Flight Connectivity: Many Tier 2 and Tier 3 cities lack direct commercial flights, prompting the use of private jets to bridge these gaps.

- Increase in HNWI Population: As wealth increases, luxury travel options, including private jets, become more accessible and attractive.

- Health and Safety Concerns: Post-pandemic, private aviation’s appeal has increased due to enhanced privacy and reduced exposure compared to commercial air travel. Safety also includes comfort in-flight—ever wondered if private jets experience more turbulence?

Key Market Players

India’s private jet ecosystem includes:

- Private Jet Owners: Industrialists, business conglomerates, NRIs, and celebrities who own jets outright.

- Charter Operators: Companies offering on-demand private jet charters, such as JetSetGo, Club One Air, and others. Customers can also benefit from discounted empty leg flights, available when jets return empty after a one-way drop.

- Leasing and Fractional Ownership Providers: Emerging models allow customers to share ownership or purchase flight hours, reducing cost barriers.

- Maintenance and Support Services: Specialized firms provide aircraft maintenance, crew training, and operational support critical for safety and efficiency.

Regulatory Environment and Infrastructure

The Directorate General of Civil Aviation (DGCA) regulates private aviation in India, overseeing aircraft registration, pilot licensing, and safety compliance. While regulatory frameworks have evolved to support private aviation growth, infrastructure constraints remain:

- Limited number of airports with private jet handling facilities.

- Challenges in airspace management impacting operational efficiency.

- Initiatives are underway to upgrade airports and streamline approvals to foster market expansion.

Market Challenges and Opportunities

Challenges:

- High acquisition and operating costs restrict ownership to the ultra-wealthy.

- Infrastructure gaps and limited FBO (Fixed Base Operator) services constrain market growth.

- Complex regulatory approvals can delay aircraft operations.

Opportunities:

- Rising interest in fractional ownership and jet card programs can broaden access.

- Airport modernization and an increasing number of private terminals will enhance convenience.

- Technology adoption, such as digital booking platforms, will simplify customer experience.

- Sustainability trends may drive demand for more fuel-efficient and electric aircraft in the future.

India’s private jet market is expanding steadily, with a diverse fleet serving growing business and luxury travel demands. Key players span owners, charter operators, and service providers, operating within an evolving regulatory and infrastructural landscape. Despite challenges, emerging ownership models and infrastructure investments present significant opportunities for sustained growth.

Cost-Benefit Analysis of Private Jet Ownership in India

Initial Acquisition Costs

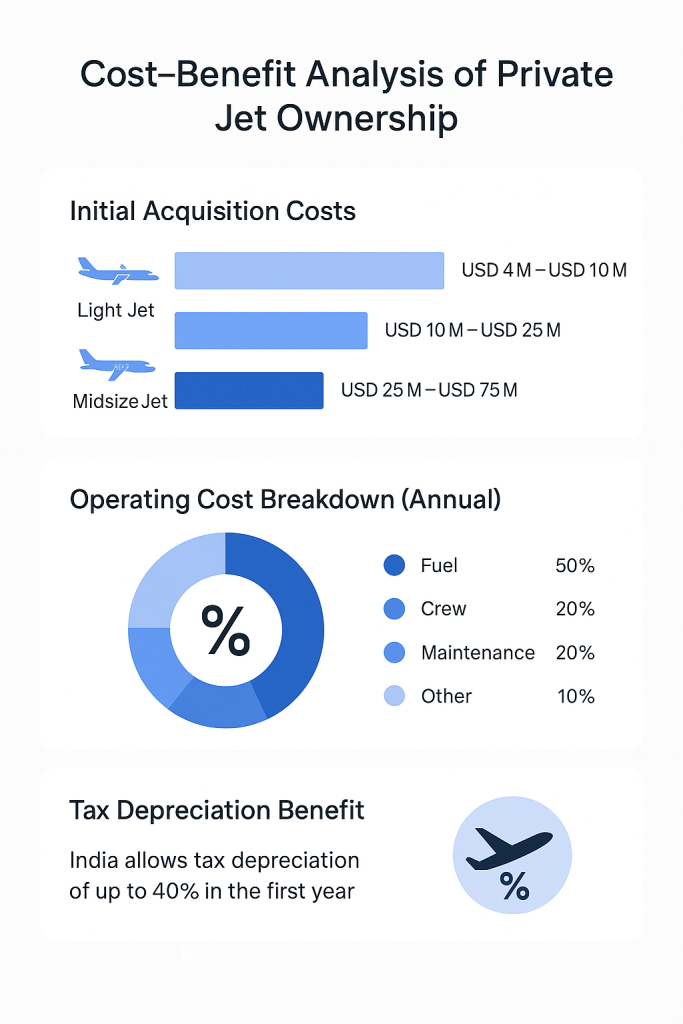

The decision to purchase a private jet is a significant investment, often driven by the need for operational efficiency, time savings, and convenience. In India, the cost of acquiring a private jet can vary widely depending on the type, size, and range of the aircraft:

- Light Jets (e.g., Cessna Citation, Embraer Phenom):

- Price Range: USD 4 million – USD 10 million

- Capacity: 4–8 passengers

- Range: 1,000–2,000 nautical miles

- Common Use: Short-haul domestic travel, regional flights

- Midsize Jets (e.g., Bombardier Challenger 350, Gulfstream G200):

- Price Range: USD 10 million – USD 25 million

- Capacity: 6–9 passengers

- Range: 2,500–3,000 nautical miles

- Common Use: Regional business travel, intercontinental flights

- Large Jets (e.g., Gulfstream G650, Bombardier Global 7500):

- Price Range: USD 25 million – USD 75 million

- Capacity: 10–19 passengers

- Range: 5,000–7,000 nautical miles

- Common Use: International business travel, high-comfort flights

Acquisition costs are substantial, but for businesses and high-net-worth individuals (HNWI), the ability to optimize travel time and control schedules justifies the expenditure.

Ongoing Operating Costs

Owning a private jet involves several ongoing operational costs, which can amount to USD 1 million to USD 3 million annually, depending on the size and frequency of use. This raises frequent questions about the long-term airworthiness of older aircraft, such as whether a 20-year-old private jet is still considered safe. These costs include:

- Fuel

- One of the largest ongoing expenses, with private jets consuming between 100–300 gallons of fuel per hour.

- Cost per gallon: USD 4–7 (varies based on location, fuel prices, and jet type).

- Crew Salaries

- A typical private jet requires at least two pilots and cabin crew (depending on jet size).

- Annual salaries: USD 200,000 to USD 600,000 depending on crew size and aircraft type.

- Maintenance and Insurance

- Maintenance includes routine servicing, repairs, and occasional upgrades. The frequency and cost of upkeep depend partly on the lifespan of a private jet, which varies by usage and model.

- Insurance costs: Typically between USD 50,000 and USD 200,000 per year, depending on aircraft value.

- Hangar and Parking Fees

- Aircraft must be stored in hangars when not in use, incurring fees at private or regional airports. But where do people actually keep their private jets? Hangarage at private terminals or smaller airports is the most common solution.

- Cost: USD 100,000 to USD 300,000 annually.

- Regulatory Compliance and Taxes

- Owners must adhere to regulatory requirements and pay taxes on their jets (e.g., registration fees, aircraft usage tax).

- Cost: Varies based on country and region, with some states in India imposing additional taxes on private aviation.

Comparison with Alternative Travel Options

While the operating costs of a private jet can be high, the time saved and the convenience—plus the fact that private jets are often faster than commercial jets—make them appealing for frequent travelers.

- Commercial First-Class Travel:

- Cost per flight: USD 5,000–10,000 (domestic flights), USD 15,000–50,000 (international flights).

- Drawbacks: Fixed schedules, less privacy, security screening, and limited flexibility.

- Charter Services:

- Cost per hour: USD 2,000–6,000, depending on the type of aircraft.

- Drawbacks: Higher per-hour cost compared to ownership, less control over availability, and limited customization options.

Cost Comparison Example (Domestic, One-Way):

- Private Jet Ownership: USD 10,000–15,000 per hour of flight time (maintenance and operational costs included).

- Commercial First-Class: USD 5,000–10,000 for a luxury seat.

- Charter Service: USD 6,000–8,000 per hour, based on the aircraft model. Still deciding? Here’s a detailed breakdown comparing first class vs private jet options for business and luxury travelers.

Although private jet ownership can be significantly more expensive than commercial or charter options, for those with frequent travel needs or high privacy demands, the flexibility, time savings, and comfort provided by private jets can justify the cost. Another draw is speed—how fast do private jets fly compared to commercial alternatives is often surprising.

Taxation and Depreciation Benefits

One of the key financial benefits of owning a private jet in India is the tax depreciation advantage. The Indian government allows depreciation of up to 40% of the asset value in the first year. This can significantly reduce taxable income for companies, making the purchase of a private jet more financially viable for business owners.

Advantages of Private Jet Ownership

- Time Savings:

- No waiting for commercial flights or security lines. Owners can optimize their schedules, including multiple city visits in a single day.

- Increased Productivity:

- In-flight workspaces, meetings, and privacy allow executives to continue business activities, making the most of travel time.

- Privacy and Comfort:

- Private jets offer enhanced comfort and the ability to tailor the cabin environment to specific needs.

- Access to Smaller Airports:

- Many private jets can land at smaller regional airports that commercial airlines do not serve, providing faster and more direct routes.

Private jet ownership in India offers significant advantages in terms of convenience, time savings, and productivity, especially for those with high travel demands. Some private aircraft are also repurposed for medical emergencies, as seen with the growing use of air ambulance services in India. However, the high initial costs, ongoing operational expenses, and maintenance requirements make ownership suitable primarily for HNWIs and corporations with frequent travel needs. For occasional users, charter services or fractional ownership programs can be viable alternatives.

Technological Trends and Innovations in Private Jet Aviation Relevant to Indian Owners

1. Advancements in Fuel Efficiency and Sustainability

One of the most notable trends in private aviation is the shift towards more fuel-efficient and eco-friendly aircraft. With increasing concerns about environmental sustainability, both manufacturers and owners are focusing on reducing the carbon footprint of private jets.

- Fuel-Efficient Engines: Modern jets are equipped with advanced engines that offer better fuel efficiency, leading to reduced operating costs and emissions.

- Sustainable Aviation Fuels (SAF): SAF is a renewable fuel alternative to traditional aviation fuel. Several Indian operators are starting to integrate SAF into their fleets to align with global sustainability initiatives. Though SAF is currently more expensive than conventional jet fuel, its adoption is expected to grow as production scales up.

Example: The Gulfstream G500 and G600 models are equipped with advanced engines that increase fuel efficiency by 15-20% compared to older models.

2. Electric and Hybrid Aircraft

As part of the broader trend toward sustainability, electric and hybrid aircraft are making their way into the private aviation sector. While still in early stages, these aircraft promise to revolutionize the industry by providing a more environmentally friendly and cost-effective way to travel.

- Hybrid Aircraft: Some manufacturers are developing hybrid jets that use both traditional jet engines and electric power, significantly reducing fuel consumption.

- Electric Aircraft: While still in prototype phase, electric aircraft for shorter regional flights are being tested by companies like Lilium and Joby Aviation. In India, this technology could be pivotal in regions with limited infrastructure and for intra-city air travel.

Example: The Alice aircraft by Israeli manufacturer Eviation Aircraft is an all-electric, zero-emission aircraft expected to hit the market within the next decade.

3. Advanced Avionics and In-Cabin Technology

Technological advancements in avionics and in-cabin features are enhancing the overall experience for private jet owners. At the same time, safety remains a top concern, leading many to ask what is the safest private jet in the world. These innovations improve safety, comfort, and convenience, making private jet travel even more desirable for Indian owners.

- Next-Gen Cockpits: Modern avionics systems, including autopilot, fly-by-wire technology, and touchscreen controls, are improving the ease of operation and safety of private jets.

- Cabin Comfort: From noise-canceling technology to customizable lighting and state-of-the-art entertainment systems, the in-cabin experience has become a major selling point for private jet manufacturers.

- Wi-Fi and Connectivity: The demand for high-speed internet and seamless connectivity has led to the introduction of satellite-based internet systems like Gogo Avance L5, offering reliable high-speed connectivity in-flight.

Example: The Gulfstream G650ER is equipped with cutting-edge avionics and an integrated cabin management system, allowing passengers to control lighting, temperature, and entertainment options via mobile devices.

4. Fractional Ownership and Digital Platforms

As the cost of full private jet ownership remains high, fractional ownership models have emerged as a cost-effective alternative. Fractional ownership allows multiple owners to share the costs and usage of a jet, making private aviation more accessible to a broader audience.

- Digital Platforms: Companies like JetPrivilege and ClubOne Air are leveraging digital platforms for fractional ownership, where buyers can purchase flight hours instead of the entire jet. This model reduces upfront costs and operating expenses while still offering access to private jets.

- On-Demand Jet Booking: Digital platforms and apps like Blade India and JetSetGo are transforming the private aviation market by allowing users to book private jets on-demand, offering flexible scheduling, and enabling access to jets at lower costs. These platforms also answer a common question—can individuals book just a seat on private jets?

5. Smart Airports and Enhanced Infrastructure

In India, the growth of private jet ownership is also driving improvements in airport infrastructure. Many airports are now investing in Dedicated Fixed Base Operators (FBOs) to cater to private jet passengers, providing services such as VIP lounges, customs clearance, and quick turnaround times.

- Dedicated Jet Terminals: Airports like Chhatrapati Shivaji Maharaj International Airport (Mumbai) and Indira Gandhi International Airport (Delhi) are investing in FBOs, which are private terminals specifically for private jet owners.

- Smarter Security and Check-In: With the adoption of biometric identification and automated check-in systems, the time spent at airports has been reduced, making private air travel even more efficient.

6. Personalized Aircraft Customization

Many high-net-worth individuals in India are opting for personalized jet interiors, making customization one of the most exciting trends in private aviation. These customizations can range from luxury seating and custom carpets to high-end entertainment systems and bespoke décor, reflecting the personal style and preferences of the owner.

- Luxury Interiors: Aircraft manufacturers like Bombardier and Dassault offer highly customizable cabin interiors, including ultra-luxurious leather seats, marble finishes, and even personal spaces like bedrooms and full bathrooms.

- Health-Conscious Features: With growing attention to wellness, private jets are also being equipped with air purifiers, anti-stress lighting, and ergonomic seating to enhance comfort and reduce fatigue during flights.

Technological advancements in fuel efficiency, electric and hybrid aircraft, avionics, and in-cabin technology are revolutionizing the private aviation sector. Fractional ownership models and digital platforms are making private jets more accessible, while the improvement of airport infrastructure in India supports the growing demand. As sustainability becomes a priority, Indian private jet owners are embracing greener alternatives and personalized services that redefine the private air travel experience.

Comparative Analysis: Indian Private Jet Ownership Vs. Global Markets

India’s private jet market is growing rapidly, but still lags behind global leaders. That said, billionaire luxury private jets showcase how high-net-worth individuals worldwide invest in elite aviation assets. While the United States boasts over 13,000 private jets, and China has around 600, India’s fleet is estimated at 200-250 jets, with a 12-15% annual growth rate. The Middle East has also seen substantial growth, particularly in countries like the UAE and Saudi Arabia.

Key factors influencing private jet ownership in India include a rising wealth base with over 830,000 HNWIs and increasing business aviation needs due to India’s vast geography. Indian owners seek flexibility, time efficiency, and privacy, with private jets becoming a symbol of both luxury and business utility.

However, challenges remain, such as limited airport infrastructure, complex regulatory hurdles, and high operating costs. Some concerns stem from misconceptions—here are the top private jet myths debunked.Despite these, there are significant opportunities for growth, driven by fractional ownership, charter services, and increased focus on sustainable aviation technologies like hybrid and electric aircraft.

India’s market is expanding rapidly, and with improvements in infrastructure and government policies, it has the potential to become a key player in the global private aviation sector in the coming years.

Conclusion

India’s private jet market is rapidly evolving, driven by increasing wealth, expanding business opportunities, and a growing desire for luxury and convenience. With an annual CAGR of 12-15%, the market is poised for substantial growth, with projections estimating the fleet could double by 2035.

Despite challenges such as limited airport infrastructure, complex regulations, and high operational costs, significant opportunities for growth lie in fractional ownership, digital platforms, and the push for sustainable aviation technologies. Additionally, the government’s ongoing investments in airport infrastructure and the increasing availability of dedicated private jet terminals will further ease operational challenges and increase accessibility.

As India’s economic landscape continues to evolve and the number of high-net-worth individuals (HNWIs) rises, demand for private aviation will only increase. By adopting fractional ownership models, embracing technological innovations, and focusing on sustainability, India’s private jet market is set to emerge as a global leader in the coming years.

Key Takeaways:

- India’s private jet market is on an upward trajectory, with strong growth expected in the next decade.

- Sustainability and technology are key drivers shaping the future of private aviation.

- Fractional ownership and digital platforms are making private aviation more accessible to a wider audience.

We’d love to hear your thoughts!

How do you see the future of private jet ownership in India? Are you excited about the growth of sustainable aviation technologies, or do you have concerns about the barriers to ownership? Share your insights and opinions in the comments below!