Private aviation has experienced a significant surge over the last decade, fueled by global economic expansion, increased health consciousness post-COVID-19, and the rising demand for time efficiency among business leaders and high-net-worth individuals (HNWIs). As more organizations and individuals explore the value of private jet ownership, a fundamental question arises: what is the lifespan of a private jet?

Understanding the operational lifespan of a private aircraft is essential for making informed financial, operational, and strategic decisions. Unlike commercial airliners, which may remain in service for over 30 years under high-utilization conditions, private jets often have vastly different usage patterns. Their longevity is influenced by a range of variables, including aircraft type, annual flight hours, maintenance standards, and technological relevancy.

In this article, we take a data-centric look at the lifecycle of private jets. We examine the typical age limits, resale dynamics, cost implications, and value retention curves, providing a comprehensive guide for prospective buyers, aviation investors, and asset managers.

By combining statistical trends with expert insights, this report will clarify:

- How long private jets typically remain operational and financially viable.

- What factors accelerate or extend a jet’s life.

- Why strategic lifecycle planning can optimize return on investment (ROI).

Whether considering fractional ownership, full acquisition, or fleet modernization, knowing the lifespan of a private jet enables smarter capital allocation and risk management. Options like private jet leasing offer flexibility without full ownership costs. In the next section, we’ll dive into the numbers and analysis that matter most.

Lifespan of a Private Jet — Key Metrics, Trends, and Investment Considerations

(A) Average Lifespan of a Private Jet

So, what is the lifespan of a private jet in real terms? On average, private jets have an operational lifespan of 20 to 30 years or 8,000 to 15,000 flight hours. However, this lifespan is not fixed and varies significantly based on usage intensity, aircraft class, maintenance quality, and upgrade investments.

For example, a Gulfstream G550 may comfortably operate beyond 14,000 hours with rigorous maintenance, while a light jet like the Cessna Citation CJ3+ may be retired earlier due to cost-inefficiencies rather than mechanical limitations.

The Federal Aviation Administration (FAA) and European Union Aviation Safety Agency (EASA) do not impose strict age limits but require continued compliance with airworthiness directives, which often become more demanding—and costly—as aircraft age.

(B) Lifespan by Aircraft Type

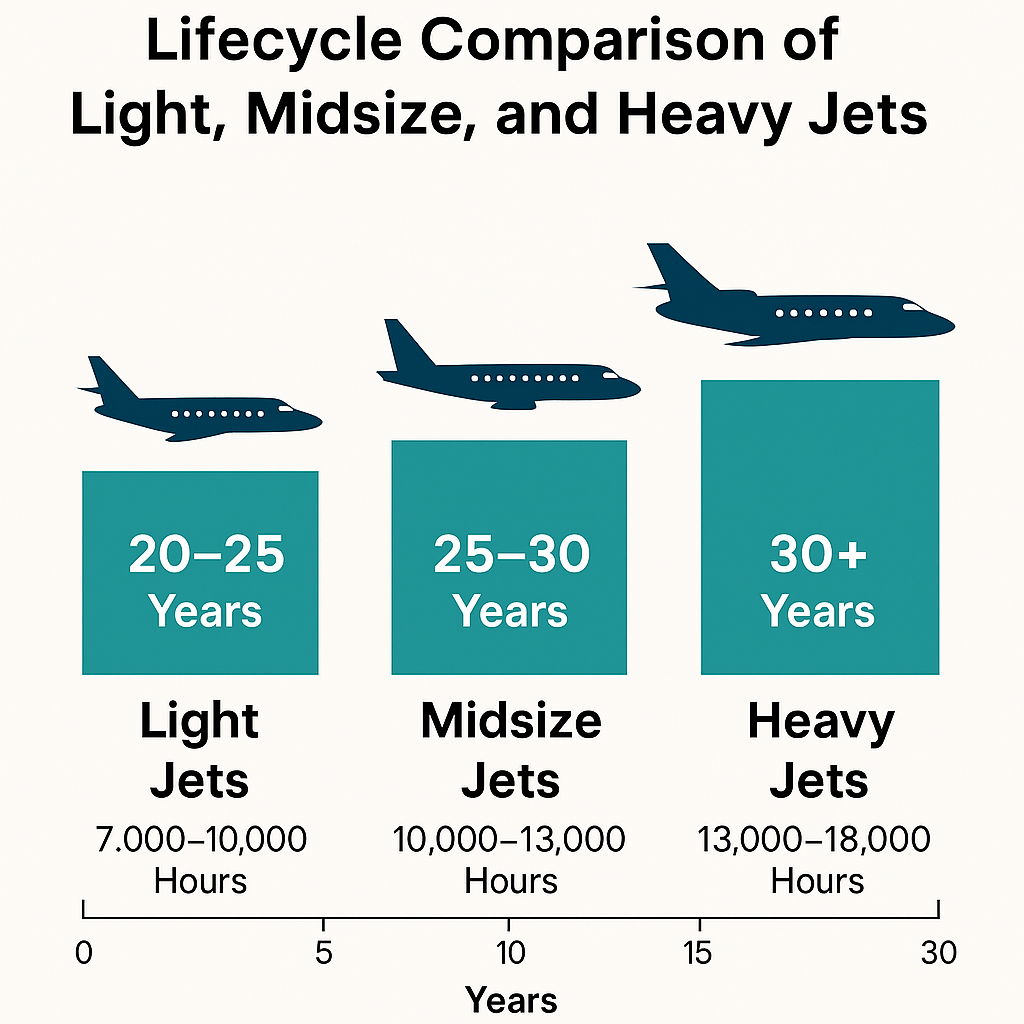

Aircraft category plays a vital role in determining longevity. Larger and more complex jets are generally engineered for extended durability:

| Aircraft Type | Average Lifespan (Years) | Flight Hours | Example Models |

|---|---|---|---|

| Light Jets | 20–25 years | 7,000–10,000 hrs | Embraer Phenom 100, Citation M2 |

| Midsize Jets | 25–30 years | 10,000–13,000 hrs | Hawker 800XP, Citation XLS+ |

| Super Midsize Jets | 25–30 years | 12,000–15,000 hrs | Challenger 350, Legacy 500 |

| Heavy/Long-Range Jets | 30+ years | 13,000–18,000 hrs | Gulfstream G650, Bombardier Global 7500 |

Long-range jets like the Gulfstream G650 are designed for extended missions—some can fly for up to 12 hours nonstop. Light jets tend to age faster due to more frequent cycles (takeoffs/landings), while heavy jets are built for longer missions and more durable operations. Their altitude advantage also matters—private jets can fly much higher than commercial planes.

(C) Flight Hours vs. Calendar Years: Which Matters More?

While calendar years are often referenced in resale conversations, flight hours and cycles are the primary indicators of an aircraft’s real wear. For example:

- A 15-year-old jet with 3,000 hours may be in better condition than a 7-year-old jet with 8,000 hours.

- Flight cycles (takeoff-landing events) particularly stress landing gear, pressurization systems, and airframes. Some worry about comfort—do private jets experience more turbulence? It often depends on altitude and aircraft type.

In corporate fleets, where utilization may only average 200–400 hours per year, private jets age slower in terms of engine wear but may suffer from technological obsolescence faster.

(D) Key Factors That Influence a Jet’s Lifespan

- Airframe Integrity: Structural fatigue can develop over time, especially in high-cycle operations.

- Engine Maintenance: Engines typically require major overhauls every 3,000–5,000 hours. Cost per overhaul can exceed $1–3 million per engine depending on model.

- Avionics and Connectivity: Outdated systems (e.g., analog cockpits or non-ADS-B compliant units) can force early retirement due to regulatory or resale pressures.

- Operational Environment: Harsh climates, poor hangaring, and salt-air exposure (e.g., coastal bases) can accelerate corrosion and deterioration.

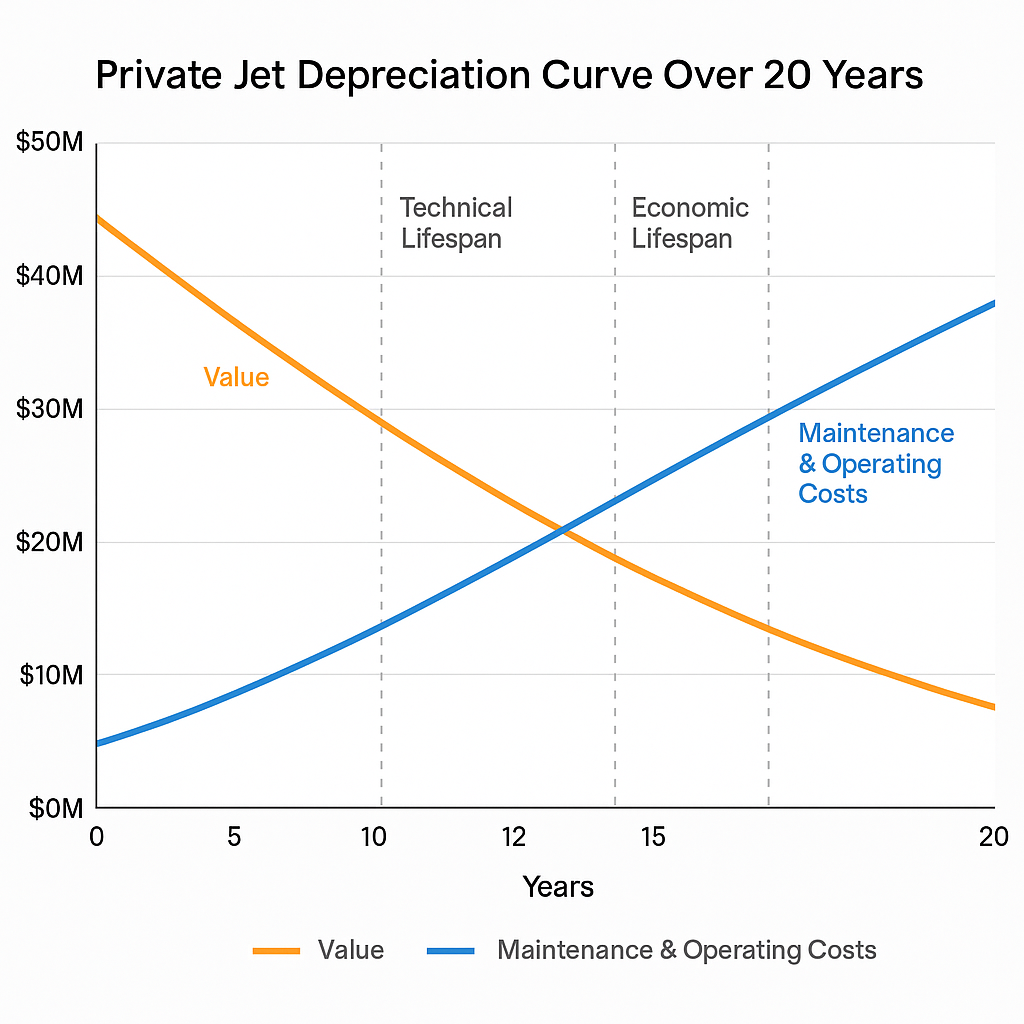

(E) Technical Life vs. Economic Life

It is critical to differentiate technical lifespan (how long a jet can fly safely) from economic lifespan (how long it makes financial sense to operate).

For example:

- A Dassault Falcon 2000 may technically operate for 30 years, but many wonder: is a 20-year-old private jet safe? The answer depends on how well it’s maintained and upgraded.

- Depreciation curves show that jets lose 30–50% of their value within the first five years and up to 75% over 15 years. High-profile examples like the Kylie Jenner private jet draw attention to the cost of luxury in aviation.

Owners must weigh

- Ongoing maintenance vs. reliability

- Upgrade costs vs. resale value

- Downtime risks vs. fleet modernization benefits

Ownership Economics — Depreciation, Maintenance, and ROI

1. Depreciation Schedule of Private Jets

Understanding depreciation is critical when evaluating what is the lifespan of a private jet from a financial perspective. Most private jets follow a steep depreciation curve within the first 10 years of ownership:

| Years in Service | Typical Depreciation % |

|---|---|

| 0–5 years | 30–50% |

| 6–10 years | 10–20% additional |

| 11–20 years | Gradual 5–10% per 5 years |

- Example: A new Gulfstream G650ER with an acquisition cost of $70 million may be valued at approximately $35–40 million after 5 years, and around $20–25 million by year 15, depending on hours and maintenance history.

- Light jets, such as the Phenom 300, depreciate faster due to lower demand in secondary markets and shorter operational lifespan.

This illustrates that while the technical lifespan of a private jet may extend beyond 25 years, the economic value can decline sharply well before that.

2. Maintenance Milestones and Costs

Maintenance is the single largest operational cost after depreciation. The maintenance lifecycle of a jet includes:

- A-Checks (Routine) – Performed every 200–400 flight hours; minimal downtime and cost.

- C-Checks / Major Inspections – Every 6–8 years or 3,000+ flight hours; includes airframe teardown and system overhaul.

- Engine Overhauls – Required every 3,000–5,000 hours; cost per engine ranges from $1M–$4M.

Engine Maintenance Programs (EMPs) such as JSSI or Rolls-Royce CorporateCare are increasingly standard, allowing owners to budget $200–500 per engine per hour.

Interior refurbishments, often needed around year 8–10, can cost $500,000 to $1.5 million depending on aircraft class and quality standards. For shorter-range transport, private helicopters may offer a more cost-effective alternative.

3. Total Cost of Ownership vs. Lifespan Value

The Total Cost of Ownership (TCO) model should consider both capital and operating expenses over the jet’s lifecycle. Here’s a simplified 15-year ownership cost summary for a midsize jet:

| Cost Element | 15-Year Estimate |

|---|---|

| Purchase Price | $15M |

| Depreciation Loss | $10M |

| Scheduled Maintenance | $4M |

| Unscheduled Repairs & Parts | $2M |

| Crew, Insurance, Hangarage | $6M |

| Fuel (avg. 300 hrs/year) | $5M |

| Total Ownership Cost | $42M |

If resold at $5M after 15 years, the net TCO becomes $37M, or roughly $8,200 per flight hour. When evaluating what is the lifespan of a private jet, this per-hour cost gives clearer insight into economic value than age or flight hours alone.

Refurbishment and Upgrades — Extending Useful Life

1. Interior Refurbishments

While the technical lifespan of a private jet may exceed 25 years, the perceived market value and usability are often extended through periodic refurbishments. Most owners or operators invest in cabin upgrades every 7 to 10 years to align with passenger expectations and maintain resale competitiveness.

- Typical interior refurbishments cost between $500,000 and $2 million, depending on aircraft size and luxury level.

- Upgrades include seat reupholstering, wood veneer replacements, cabin lighting, carpet replacement, and entertainment systems.

- A well-maintained and recently refurbished cabin can add 5–10% to resale value and significantly improve charter appeal.

2. Avionics and Connectivity Upgrades

Modern private jet users demand real-time connectivity, safety compliance, and advanced avionics—which makes periodic upgrades essential for extending the aircraft’s economic lifespan.

Key upgrades include:

- Avionics Suite Modernization: Replacing outdated analog systems with digital cockpits, such as Garmin G5000 or Collins Pro Line Fusion.

- Compliance Upgrades: Mandates like ADS-B Out, FANS 1/A, and CPDLC are increasingly enforced in controlled airspace.

- Connectivity Enhancements: Installing Gogo AVANCE L5 or Satcom Direct for broadband internet can cost $100,000 to $300,000, but is critical for business operations in-flight.

Jets that lack compliance with these evolving standards may be grounded or severely devalued, regardless of mechanical condition. Hangarage is a major cost—and yes, here’s where people keep their private jets when not flying.

3. Airworthiness Directives and Regulatory Compliance

As aircraft age, the frequency and cost of compliance-related maintenance increase. Regulatory agencies like the FAA or EASA may issue Airworthiness Directives (ADs) requiring:

- Structural inspections (e.g., fuselage skin, wing root fatigue).

- Replacement of outdated fuel system components.

- Modifications to comply with noise or emission standards.

Neglecting these directives can render a jet non-compliant, regardless of its mechanical viability. Many older jets are retired not due to system failure, but due to non-compliance penalties or prohibitive upgrade costs.

Residual Value and Secondary Market Dynamics

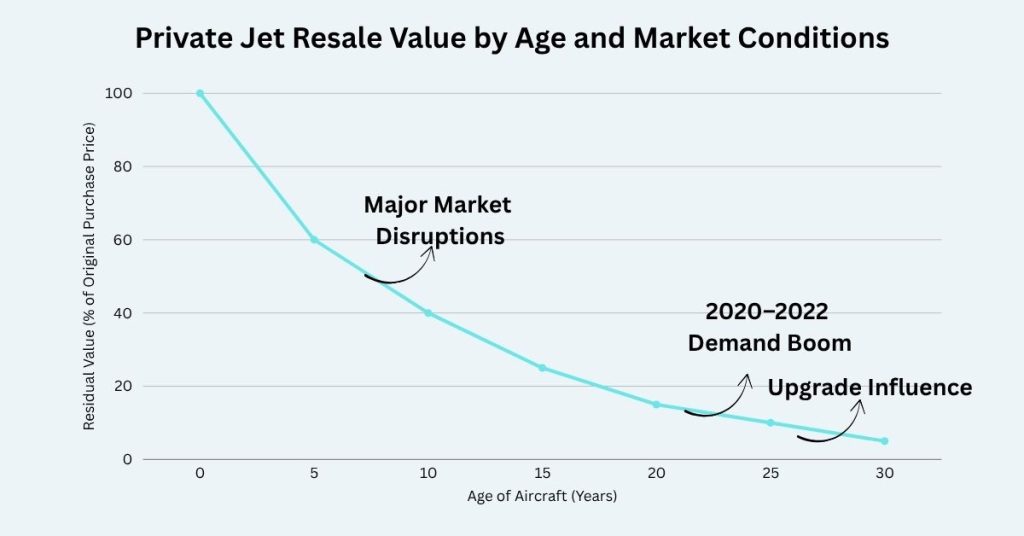

1. Understanding Residual Value in Private Jets

One of the key aspects in assessing what is the lifespan of a private jet is analyzing its residual value—the estimated market worth at any given point post-acquisition. Residual value is influenced not just by age or flight hours, but by:

- Aircraft condition and maintenance records (logbooks, damage history).

- Total time on airframe and engines.

- Upgrade history (avionics, interior, connectivity).

- Compliance with airworthiness mandates.

According to VREF and AMSTAT, most private jets retain:

- 40–50% of their value at year 5.

- 25–35% at year 10.

- 10–20% at year 15.

Example:

A Challenger 350 purchased new at $27 million might retain:

- ~$13M after 5 years.

- ~$7M after 10 years.

- ~$4M or less after 15 years, depending on hours and records.

Buyers in the resale market are typically charter operators, corporate buyers in emerging markets, or Part 135 fleet operators looking for value aircraft with acceptable maintenance overhead. In India, even celebrities like top cricketers own private jets for travel flexibility.

While most individuals own one or two jets, some celebrities and billionaires own as many as 10 private jets.

2. Trends in the Secondary Market

The private aviation secondary market is cyclical, highly influenced by macroeconomic trends:

- 2020–2022 boom: Driven by pandemic-era travel shifts, resale inventory dropped by over 60%.

- Post-2023 normalization: Inventory has started to stabilize; values have corrected but remain above pre-COVID levels.

Other trends shaping residual value include:

- OEM support longevity: Aircraft with discontinued support (e.g., Hawker 800 series) see faster value erosion. For longevity and value retention, consider models among the best private jets currently available.

- Green mandates and sustainability factors: Buyers are increasingly factoring fuel efficiency, emissions, and noise compliance—impacting the resale value of older, non-upgraded aircraft.

Fleet modernization trends also play a role:

- Many fractional and charter operators retire jets between 10,000–12,000 hours to avoid major maintenance spikes and to maintain passenger appeal. The trend is also catching on in developing markets—see how private jets in India are evolving.

Charter and Fractional Ownership — Utilization vs. Lifespan Optimization

1. High-Utilization Models and Their Impact

Charter and fractional ownership programs like NetJets, Flexjet, and VistaJet operate on high-utilization schedules, often flying jets 800–1,200 hours annually—significantly more than the average 300–400 hours for individually owned aircraft. High-speed capabilities are essential—learn how fast private jets actually fly

This heavy usage compresses the economic lifespan of the aircraft, but the business model compensates with:

- Aggressive preventive maintenance schedules

- Full engine and avionics support programs

- Planned refurbishment cycles every 4–6 years

As a result, even though these jets age faster in flight hours, they remain commercially viable through strategic lifecycle planning and strong OEM maintenance partnerships.

Example:

- A Bombardier Challenger 350 in fractional service may reach 12,000 flight hours in 10–12 years, at which point the operator may retire or sell the asset before major cost thresholds (e.g., engine overhaul or airframe inspection cycles).

2. Fleet Retirement and Renewal Strategies

Unlike private owners who often retain jets for personal legacy or non-financial reasons, charter and fractional firms base aircraft retirement on:

- Maintenance cost forecasts

- Customer satisfaction and brand perception

- Resale market timing

When weighing first class vs private jet, ownership adds control—but at a price.

These companies generally retire jets:

- Between 10,000–14,000 hours or

- At 12–15 calendar years, depending on utilization rate and depreciation trends

Many aircraft are sold into emerging markets or Part 135 operators who find remaining value at lower acquisition cost, particularly when upgrades and maintenance are well-documented.

This model reveals a key insight into what is the lifespan of a private jet: not just how long it can fly, but how effectively its lifecycle is managed relative to its mission.

Conclusion & Strategic Takeaways

In evaluating what is the lifespan of a private jet, it’s clear that longevity is shaped not just by engineering limits, but by economic viability, regulatory compliance, and mission alignment. While most private jets can technically fly for 20 to 30 years or more, their economic lifespan—the period during which they deliver profitable or efficient value—can be substantially shorter.

From a business perspective, lifecycle planning must integrate:

- Depreciation forecasts based on aircraft type and usage profile.

- Maintenance and refurbishment cycles to extend asset value and passenger appeal.

- Technology and regulatory compliance upgrades to remain airworthy and competitive.

- Exit strategies, including resale market positioning, to protect residual value.

- In medical emergencies, air ambulance services in India rely on jets maintained to the highest standards.

For private owners, a jet is more than a transportation tool—it is an appreciating liability. Failing to plan for midlife upgrades or resale timing can sharply reduce ROI. Conversely, fleet operators and fractional ownership companies have demonstrated how strategic use of high-utilization models and early-cycle asset renewal can extract maximum utility while preserving market value. On the extreme end, billionaire luxury private jets boast features far beyond business utility. Much of the industry is misunderstood—many private jet myths distort the realities of cost and usage.

Ultimately, the true lifespan of a private jet is not measured solely in hours or years—but in how efficiently and strategically its lifecycle is managed. Cost-conscious travelers can tap into empty leg flights for significant savings without owning a jet. Whether you are an investor, owner, or advisor, aligning asset utilization with economic performance and compliance thresholds is key to long-term value creation.

Are you considering buying, leasing, or upgrading a jet? Let us know what factors matter most to you—lifespan, resale value, or operating cost?